You could examine these firms based on client testimonials, monetary stamina ratings and the types of protection supplied - risks. You will certainly require to provide information regarding your organization, including what the organization does, exactly how long it's been around and what your firm automobiles are made use of for.

Along with the make, model and also year, you might also require to reveal details like the car's initial cost, the weight and also size, just how much staff members usually drive and who the main motorist of the lorry is. Next, be prepared to offer some details regarding individuals who drive the lorries - vans.

Regularly asked concerns, What is the very best vehicle insurer? The very best auto insurance provider is various for everybody. credit. Lots of automobile insurance provider use industrial insurance policy, so you can check out our testimonial of the finest automobile insurance provider as a starting factor. Some of our top picks that sell industrial insurance coverage are State Farm, Geico, Allstate as well as Erie.

Generally, the less vehicle drivers you need to guarantee, the less expensive your plan will be. Exactly how can I conserve money on commercial insurance coverage? You could be able to conserve cash on your commercial vehicle insurance in a few ways. Make sure to shop about and also get quotes from several service providers prior to you buy a policy.

Trick Takeaways You might require an industrial auto insurance coverage policy to cover your auto or truck if you use it for job, also if you just utilize it for organization part of the moment. Industrial auto insurance policy covers your auto or vehicle and can be reached cover your workers, even when they're driving their own automobiles.

What Does How Much Does Commercial Auto Insurance Cost? Do?

These plans will not cover damages to your very own car if you do not have a business plan with comprehensive and also accident defense. What does business car insurance policy price? Like routine automobile insurance, the price of insurance coverage for industrial automobiles depends on a range of variables, including the age of you or your vehicle drivers, crash history, and also place.

Typically, it's extra pricey to obtain industrial vehicle insurance than it is to insure a personal vehicle. While the typical car insurance policy premium is $1,652 per year, you can spend hundreds much more for industrial coverage relying on your automobile and how it's utilized. For the very best prices, we suggest comparing prices and also coverage choices from several business.

You would obtain a reimbursement in case you transformed to business car insurance policy in the center of your plan, as long as your brand-new rate isn't higher than your old rate - liability. Can you get one-day service insurance coverage for an automobile? Insurance policy protection can be found in six-month or 12-month terms.

Apart from covering lorries possessed by your business, business auto insurance policy additionally covers leased or borrowed lorries along with employees who use their vehicles for business. affordable. Covered in company car insurance coverage are the following: This pays for the fixing as well as substitute of lorries or various other residential or commercial property entailed in an accident confirmed to be created by your insured driver.

If your staff member is shown to be the at-fault vehicle driver in a mishap, this sort of insurance coverage will certainly pay for the 3rd event's lost wages in addition to clinical as well as funeral expenses. This responsibility will certainly likewise shoulder protection prices for your employee when the situation goes to court. If you, your workers, or any of your guests in a commercial car have actually been associated with a mishap triggered by an insured or underinsured motorist, insurance coverage will certainly pay for the problems.

The 9-Minute Rule for How Much Does Commercial Auto Insurance Cost – Nationwide

No matter of who's at fault, this type of coverage spends for the medical costs you, your workers, and your guests have incurred as an outcome of the crash. This spends for the damages your industrial automobile received throughout a crash, despite who's at fault. This uses to when you were hit by one more car, you hit one more lorry, an item strikes your car or vice versa, or if your lorry rolls over.

This will certainly likewise spend for your replacement automobile if it's swiped or unrecovered - car. In the occasion your commercial vehicle requires to obtain of roadside solutions such as towing or fuel, this sort of insurance coverage conserves you the difficulty of paying for them. This covers a car you have actually rented out that came to be entailed in an accident.

Obtaining a service automobile insurance policy quote from a dependable insurance firm can give you a suggestion of just how much you require to pay for the coverage you desire. Average Commercial Vehicle Insurance Coverage Expense Based on Car Type Services are different and utilize various vehicles for various functions, so the prices can be dramatically impacted by the kind of industrial car you desire to insure. low-cost auto insurance.

These can include the following: Relate to exactly how the vehicle is being utilized, such as for transport or distribution. This involves just how much is needed to repair the vehicle when it's harmed. The bigger the vehicle, the higher the insurance coverage price, as it can trigger more damage in a mishap.

The nature of your service will certainly additionally impact the costs, as some work are riskier than others - accident. For example, a truck doing long-haul distribution is more at threat contrasted to a van that delivers employees within the location of an airport terminal. The car kind as well as its age are taken into account when calculating for the suitable insurance coverage cost.

Some Known Questions About What Does Average Semi Truck Insurance Costs For Owner ....

Of program, the a lot more commercial automobiles you want to have actually covered, the higher the cost. If you have actually filed countless claims in the past, the expense of your insurance coverage is likewise most likely to boost (dui).

In this manner, you can be certain that you and also your staff members are secured when you obtain entailed in a car accident.

Working with safe vehicle drivers and complying with these chauffeur testing ideas can aid decrease business obligation in situation of an accident. cheapest. Locate a local representative in your area: Travelers Roadside Help Protection The roadway is an uncertain place.

laws risks cheaper cars suvs

laws risks cheaper cars suvs

Variables ranging from the increase in lawyer representation in bodily injury declares to the greater expenses of substitute parts for technically complex cars and trucks as well as vehicles continue to drive up insurance claim costs for insurance service providers.

Your business car insurance policy cost will certainly rely on elements like the sort of vehicle, exactly how it's utilized, and the driving documents of the people who will operate it, to call just a couple of. Nonetheless, bi, BERK has the ability to supply insurance coverage at up to 20% less than various other insurance policy suppliers.

The Only Guide to Chapter 5: Commercial Auto Insurance - Davidpope

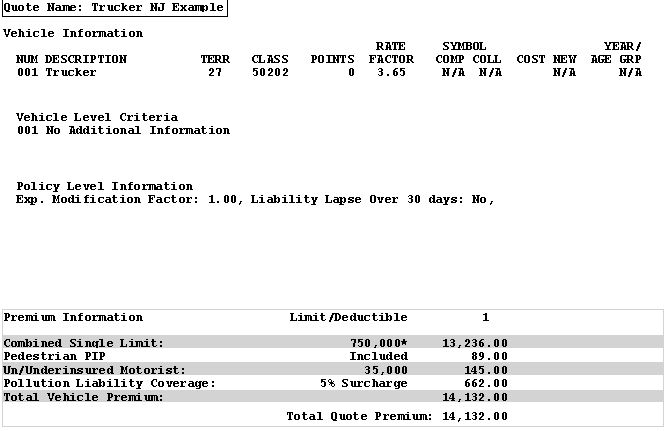

The expense to insure lorries for for-hire trucking can be $5,000 to $15,000 per car each year. Livery automobiles may cost $2,000 to $6,000 per vehicle per year to insure. insurance affordable.

Who owns the vehicle? Your vehicle will more than likely Have a peek here demand commercial vehicle insurance if it's had by an organization, however if you're the sole proprietor, you may just require an individual vehicle insurance coverage. If you just use your vehicle simply for travelling to and from job, you may be covered by your individual vehicle insurance coverage policy.

Other variables that are taken into consideration include: Price brand-new or MSRP of the lorry Kind or body style of the automobile What industry your organization is in and just how the automobile is utilized Where you drive the car Where the automobile is garaged throughout the night or non-work hours Restrictions, insurance coverages and deductibles Threat is vital an important factor to think about - vehicle.

She could worry that she will not have the ability to pay for the prompt repair prices. Her agent advises her that her business vehicle insurance will offer coverage for the resulting expenditures. The plan covers residential property damages caused to the insured's protected vehicle, in addition to 3rd party's in situation of an accident.

That consists of accident security. Uninsured drivers According to the Insurance Research Council (IRC), one in eight motorists were without insurance in 2021. The research study was based upon the ratio of without insurance vehicle driver claims to physical injury claims. A business car insurance policy pays when the insurance policy holder consults with a mishap and also sustains injuries as a result of the mistake of somebody who does not have insurance.

What Does Business Vehicle Insurance - Iii Do?

Hit-and-run drivers are likewise considered uninsured drivers (cars).

vans cheap car insurance business insurance cars

vans cheap car insurance business insurance cars

cheap insurance money cheapest auto insurance cheaper auto insurance

cheap insurance money cheapest auto insurance cheaper auto insurance

cheapest car automobile auto insurance low cost

cheapest car automobile auto insurance low cost

If you're an entrepreneur or specialist, you require to spend in business vehicle insurance. It may be alluring to cut expenses by managing on your personal auto insurance, but in instance of a mishap, the unique protection that business vehicle insurance manages might imply the distinction between the life and death of your business - cars.

This covers the damage to a third-party's automobile (repair work or replacement). Comprehensive covers repair services to or replacement of your vehicle if it is harmed due to the weather condition, criminal damage, or theft.

Accident insurance coverage will cover the damages that is done to the insurance policy holder's vehicle as long as the policyholder is at fault (cheaper car). If another party accidents your automobile, their obligation pays for repairs.: Uninsured and also Underinsured coverage is required by many states and also will certainly cover you if the various other celebration is responsible and also they do not have coverage.

It depends on the kind of car, the sector you're in, the plans you're adding, deductibles, protection restrictions, and even the insurance coverage business you pick. Did you understand that males under the age of 25 have a tendency to have the highest possible vehicle insurance policy rates?

7 Simple Techniques For Commercial Auto Insurance Quotes & Coverage

What is commercial automobile insurance coverage? Commercial automobile insurance policy is a form of car insurance policy that consists of special insurance coverages created for business usage. While much of the protections consisted of in commercial vehicle insurance resemble the insurance coverages in a personal policy, the protection limitations are usually a lot higher to suit the higher lawful dangers often related to capitalism. insure.

Personal vehicle insurance coverageIndividual auto insurance just covers you when you're driving the auto for personal factors. car insurance. This insurance coverage will certainly cover you as you drive to as well as from job, in addition to on your lunch break. If you are driving while on the clock, your personal plan will certainly not use. So if you get in a wreckage while driving at work, you won't have any insurance coverage unless you have business car insurance coverage.

Business car insurance coverage additionally offers non-owner lorry coverage. Personal car insurance, Needed for individual driving, Required for job-related driving, Lower protection limits, Greater protection limits, Usually no insurance coverage for tools, Insurance coverage for materials as well as equipment Insurance coverage for other vehicles and also chauffeurs might be excluded Consists of restricted insurance coverage for non-owned lorries and also various other motorists, Who requires business automobile insurance policy?

If you ever have staff members that drive a car possessed by your business or you, their individual automobile insurance coverage will certainly NOT cover themit needs to be insured by you. There are additionally differences in the number of lorries you can place on an individual policy versus a business plan. What does business car insurance cover? Commercial auto insurance policy consists of most of the very same conventional insurance coverages as individual vehicle insurance policy.